How can you know if you’re choosing the right managed service provider?

Your World-Class

Managed IT

Services Provider

LEVEL UP YOUR TECHNOLOGY WITH A CONSULTATION ——————

Our Vision ——————

We proactively streamline your technology experience by leveraging high-level strategies, best-in-class service applications and customized IT support, empowering you to focus on your core business.

Our Services ——————

IT Services to Propel Your Business Forward

Maintaining your infrastructure can be a real headache. Sometimes it’s easier to turn a blind eye – we get it. But the more you rely on technology, the more an IT challenge can impact your daily operations. As an industry leader, Intuitive Networks has the technology and team to effectively deliver solutions, both internally and externally, that maximize your cost savings, deliver peace of mind and ensure ultimate efficiency.

Our Services ——————

IT Services to Propel

Your Business Forward

Maintaining your infrastructure can be a real headache. Sometimes it’s easier to turn a blind eye – we get it. But, the more you rely on technology, the more an IT challenge can impact your daily operations. As an industry leader, Intuitive Networks has the technology and team to effectively deliver solutions, both internally and externally, that maximize your cost savings, deliver peace of mind and ensure ultimate efficiency.

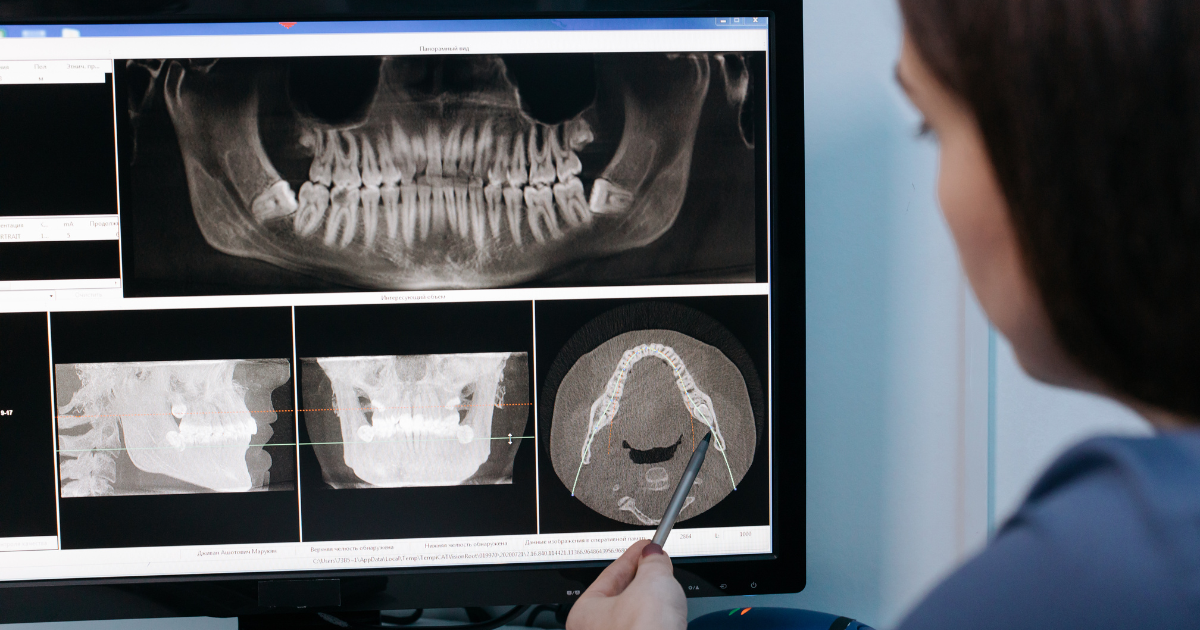

Businesses We Serve ——————

Customize Your IT Support to Fit Your Business

Wouldn’t technology be a breeze to maintain if a one-size-fits-all solution existed? Here at Intuitive Networks, we know that every business has its own unique needs. You need – and deserve – IT support crafted to solve the specific roadblocks your business faces. As your trusted managed service provider, we deliver tailored IT services to help you overcome industry-specific challenges and move forward with confidence.

Businesses We Serve ——————

Customize Your IT Support to Fit Your Business

Wouldn’t technology be a breeze to maintain if a one-size-fits-all solution existed? Here at Intuitive Networks, we know that every business has its own unique needs. You need – and deserve – IT support crafted to solve the specific roadblocks your business faces. As your trusted managed service provider, we deliver tailored IT services to help you overcome industry-specific challenges and move forward with confidence.

—————— Areas We Serve ——————

Our Service Areas

Since 2004, we have successfully provided custom IT services to organizations making a difference in our community. Intuitive Networks is proud to be the managed service provider of countless businesses in:

—————— Our Partners ——————

Learn to Grow ——————

Intuitive Networks’ Blog

Does your business need a vCIO? How can you prevent data theft on the road? Find the answers to all of your technology questions on our blog, where we help you stay up-to-date on the industry.